Today’s traders need more from a broker than just market access. They want speed, transparency, and strong liquidity. StriveFX aims to meet these needs by offering both retail-friendly access and features usually found at the institutional level.

By combining accurate ECN execution with an impressive portfolio of over 10,000 financial instruments, StriveFX targets a broad spectrum of market participants, from scalpers hunting for 0.0-pip spreads to long-term investors diversifying into bonds and crypto.

This review covers StriveFX’s main features, account options, trading conditions, and market range to help you decide if it stands out among other brokers.

Quick Ratings: StriveFX

| Spreads | Raw from 0.0 pips |

| Maximum Leverage | 1:500 |

| Platforms | Match-Trader & cTrader |

| Execution Speed | Milliseconds (ECN) |

| Market Access | 10,000+ Instruments |

What Is StriveFX?

StriveFX is a multi-asset brokerage that provides retail and professional traders with direct access to global financial markets through Contracts for Difference (CFDs).

The company uses a transparent ECN execution model, so all orders go straight to liquidity providers. This reduces slippage and provides real-time pricing. StriveFX’s primary offering is access to over 10,000 instruments, including Forex, indices, commodities, metals, bonds, and cryptocurrencies.

In addition to its core trading services, StriveFX also includes:

● Fund segregation and basic safeguards

Client funds are held in segregated accounts and kept separate from company operating capital. Negative balance protection applies to all accounts, meaning traders cannot lose more than their deposits.

● 24-hour multilingual support

Customer support is available daily by live chat, email, or phone. The website offers help in several languages for different regions.

● Learning and market resources

StriveFX offers tutorials, written guides, and daily market analysis. The trading platforms include an economic calendar and live order-book data.

Who is StriveFX For?

StriveFX is built for traders who want a clear, fast, and flexible way to trade a wide range of assets.

It’s a strong option for:

● Algorithmic Traders who need the tightest possible spreads and ultra-fast ECN execution.

● Scalpers and High-Volume Traders who benefit directly from the raw spreads starting at 0.0 pips offered on the Professional Account.

● Multi-Asset Investors looking to diversify their portfolio across Forex, Indices, Commodities, Bonds, and Cryptocurrencies from a single account.

● Beginners who can start with a low minimum deposit ($10) on the Standard Account and practice risk-free with the unlimited Demo Account.

● Experienced Traders seeking advanced technical tools and market depth visibility provided by the cTrader platform.

Thanks to its strong execution and wide market access, StriveFX is a good choice for anyone seeking a reliable global broker.

How StriveFX Works

StriveFX is a direct ECN broker that connects traders straight to the market. The setup is simple and lets you start trading quickly.

Here’s a breakdown of the process:

1. Choose Your Account Type

Traders can select from four main account types:

- Standard Account

- Professional Account

- Islamic Account

- Demo Account

Each account is designed for a different type of trader, but all offer ECN execution, high leverage, and support for automated strategies.

2. Fund Your Account

You can open a Standard or Islamic account with just $10, making it easy to get started. Your funds are kept in separate accounts for added security.

3. Trade on Advanced Platforms

You can choose the easy-to-use Match-Trader platform or the advanced cTrader platform. Both support automated trading and come with a complete set of charting tools.

4. Withdraw Profits

StriveFX offers several withdrawal methods, and Negative Balance Protection protects your funds.

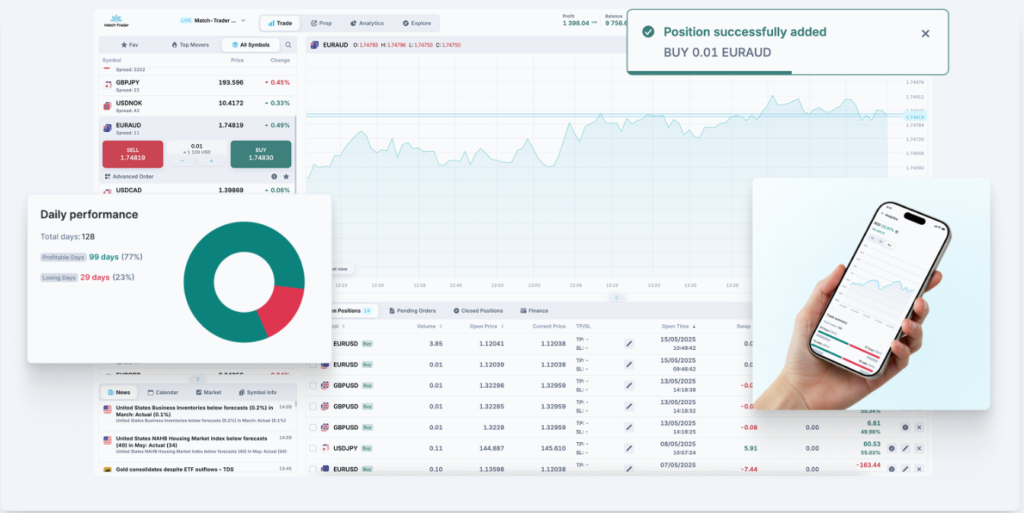

Trading Platforms: Power and Precision

StriveFX provides two strong platforms to suit different trading styles. Rather than a single solution, they focus on matching each trader with the right tool.

1. Match-Trader (Best for Accessibility)

Match-Trader is the default platform designed for modern traders who need speed and flexibility across devices.

- Key Features: Automated trading support (EAs), social trading capabilities, and a unified interface that syncs perfectly between desktop and mobile.

- Why use it: It is lightweight, easy to use, and offers fast execution without the complexity of older platforms.

- The desktop version allows multiple screens and customizable layouts, making it suitable for users running algorithmic strategies or multi-asset portfolios.

2. cTrader (Best for Advanced Analysis)

If you want advanced features, cTrader is a top choice for professional technical analysis.

- Key Features: Over 70 built-in indicators and up to 67 timeframes, cTrader Automate for algorithmic trading using C# (cBots), built-in strategy tester for back-testing and optimization, integrated economic calendar, and market news feed

- Why use it: If you are a scalper or an algo-trader, the transparency of cTrader’s order book is invaluable.

- You can use cTrader on desktop, web, or mobile. The desktop version has advanced analysis tools and connects directly with automated strategies, making it the more data-focused option.

Account Types: Which One Fits You?

StriveFX uses a simple tiered system. Whether you start with $10 or $10,000, you get the same fast execution. The main difference is in the pricing.

Standard Account

The Standard Account is the starting option for new or casual traders who want to get started easily.

- Minimum deposit: $10

- Maximum leverage: 1:500

- Spreads: from 0.3 pips

- Commission: none

- Execution: market (ECN)

- Permitted strategies: hedging, scalping, Expert Advisors

This account lets you trade over 100 instruments, with no commission on most assets. You get the same platform access, market data, and support as you do in higher tiers.

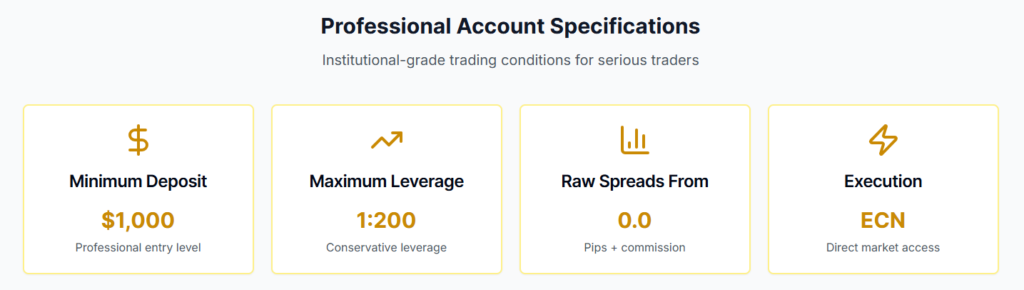

Professional Account

The Professional Account is for experienced traders or small groups who want better pricing and detailed market information.

- Minimum deposit: $1,000

- Maximum leverage: 1:200

- Spreads: raw from 0.0 pips

- Commission: $7 per lot round turn ($3.50 each side)

- Execution: ECN with Level II market depth

- Permitted strategies: hedging, scalping, Expert Advisors

Professional clients get raw institutional spreads and faster order processing. This account offers advanced charting, algorithmic trading, and premium market reports. You need to show trading experience and provide extra documents to verify your account.

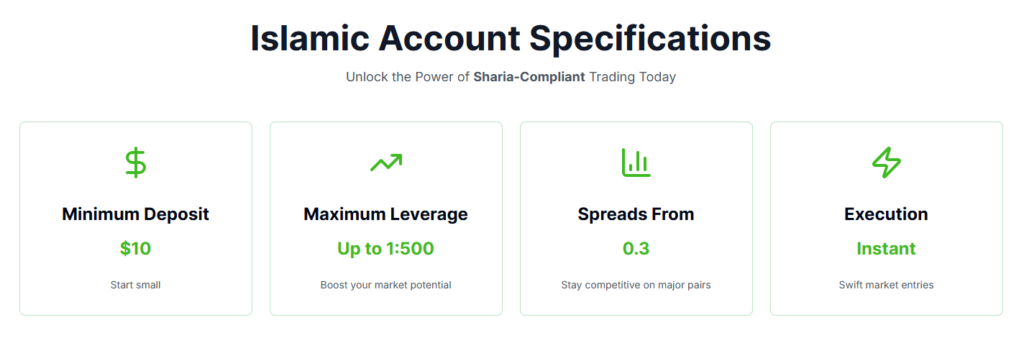

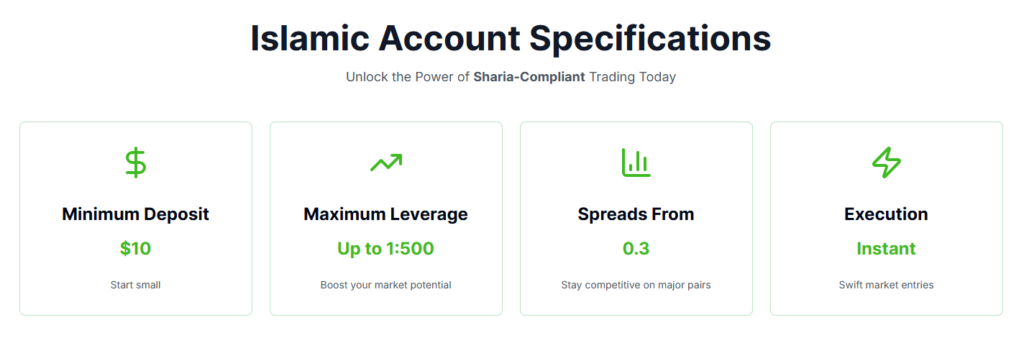

Islamic Account

This account is designed for traders who follow Islamic finance and want to avoid interest (riba).

- Minimum deposit: $10

- Maximum leverage: 1:500

- Spreads: from 0.3 pips

- Commission: $7 per lot round turn

- Swap fees: none for the first 5 days

- Admin fee: applies after 5 days to cover operational costs

You can hold positions without paying interest, as long as you follow Sharia trading rules. This account gives you full platform access, negative balance protection, and support for hedging and scalping.

Demo Account

The Demo Account lets you test strategies and learn the platform without any risk.

- Virtual balance: $100,000

- Market data: live and real-time

- Duration: unlimited

- Risk: none

You can practice in real market conditions, manage orders, and try technical tools without using real money. The demo connects you to educational resources and analysis to help you get comfortable before trading live.

Market Coverage: What Can You Trade?

StriveFX stands out for its selection of over 10,000 tradable instruments. This variety lets you manage a multi-asset portfolio in one place.

- Forex: 70+ pairs including Majors, Minors, and Exotics.

- Indices: Trade the global economy with the S&P 500, DAX 40, and Nikkei 225. Both cash and futures pricing are available.

- Commodities: Full coverage of the energy and agricultural sectors (Oil, Corn, Coffee).

- Metals: Gold (XAUUSD) and Silver with tight spreads, plus industrial metals like Copper and Aluminum.

- Bonds: Unlike most retail brokers, you can trade US Treasuries, UK Gilts, and German Bunds to manage interest rate risk.

- Cryptocurrency: 24/7 trading on significant assets like Bitcoin, Ethereum, and Solana with deep liquidity.

Pros and Cons

Here’s a look at what StriveFX does well and where it could improve.

The Pros

- Raw ECN Spreads: The Professional account offers real 0.0-pip spreads, which are key for profitable scalping.

- Low Barrier to Entry: You can start trading live with just $10 on the Standard account.

- Diverse Assets: Access to Bonds and over 10,000 instruments is superior to most standard Forex brokers.

- cTrader Integration: Access to one of the world’s most advanced trading platforms.

- High Leverage: Up to 1:500 leverage allows for efficient capital usage.

The Cons

- Islamic Account Fees: While swap-free, the Islamic account incurs an administrative fee on positions held longer than 5 days.

- Professional Deposit: The $1,000 minimum for the Raw spread account may be steep for absolute beginners.

- Bonus Rules: Promotional credits often have strict volume requirements before they can be withdrawn.

Final Verdict

StriveFX presents a compelling case as a modern, technology-driven brokerage. The combination of ultra-tight spreads on the Professional Account, a vast selection of tradable assets, and the flexibility of choosing between Match-Trader and cTrader makes it a strong contender in the competitive brokerage space.

For traders seeking a platform that supports both manual and advanced automated strategies with institutional-grade execution, StriveFX is certainly worth considering. The low barrier to entry on the Standard Account also ensures that new traders can access a high-quality environment from the start.