Pricing

They offer commission-free stock and ETF trades. Forex fees at TD are low. For example, the GBP/USD benchmark fee is $9 GBP/USD, while Interactive Brokers are $10.7. Fund fees are $50, bond fees are $0, and options fees are $6.5. For non-trading fees, deposits are free, withdrawals are free if you utilize an ACH transfer, and the broker does not charge an inactivity fee. For non-US customers, there is only one withdrawal option, which costs $25.

Platform

Mobile apps, website, and thinkorswim (desktop trading platform)

Pros

- High-quality trading platforms.

- No minimal account

- Various types of securities

- Low transaction costs

- Excellent desktop trading platform

- A wide variety of educational content is available.

Cons

- No direct access to cryptocurrencies

- No fractional shares

Customer Service

Phone support 24/7, email, Facebook/Twitter messaging

TD Ameritrade Review

TD Ameritrade is a US stockbroker governed by the SEC and FINRA. Low trading costs and one of the top desktop trading platforms on the market can be found with TD Ameritrade. The customer service team excels at responding quickly and appropriately. It is a wise decision for new investors. The broker’s services are restricted to the US and a select few other nations, and you can only trade on US markets, which is a drawback.

Over 28 million customers trust it, making it one of the biggest brokerages in the US with over $6 trillion in client assets. This is because they offer a superior customer experience by comprehending their clients’ needs. Any investor or trader, whether new or experienced, will find TD Ameritrade to be a winner, especially with $0 stock and ETF trading.

About TD Ameritrade

TD Ameritrade was created in 1975 as one of the earliest online brokerages in the United States, with headquarters in Omaha, Nebraska. Currently, it manages more than $1 trillion in assets for 11 million clients. In a deal worth around $26 billion in all-stock exchanges, Charles Schwab declared in 2019 that it would acquire TD Ameritrade.

Surprisingly, not many online brokers provide dummy trading accounts on their systems, making this a fairly uncommon offering. A desktop-based application aimed at experienced and frequent traders, paperMoney is a virtual simulator from TD Ameritrade. It gives access to a margin account and $100,000 in practice “money.” Although non-customers can sign up for a free 60-day trial, which is a fantastic method to evaluate a new platform before deciding to open a real-money account, it is accessible for free through the broker’s two platforms and its Mobile Trader app.

Who Should Use?

With a wide variety of mutual funds and low costs on online stock and ETF transactions, TD Ameritrade is a good option for both active traders and those just starting out.

TD Ameritrade Platform & Features

Education

With live webcasts, news, and commentary on practically any market-related issue, TD Ameritrade provides education for all skill levels. You’ll find many of the investing education tools you’ll need to help make the most of TD Ameritrade, ranging from simple “how to trade stocks” instructions to complex options trading sessions. Even better, TD Ameritrade makes use of its physical location by providing in-house investor sessions at its more than 175 branch locations.

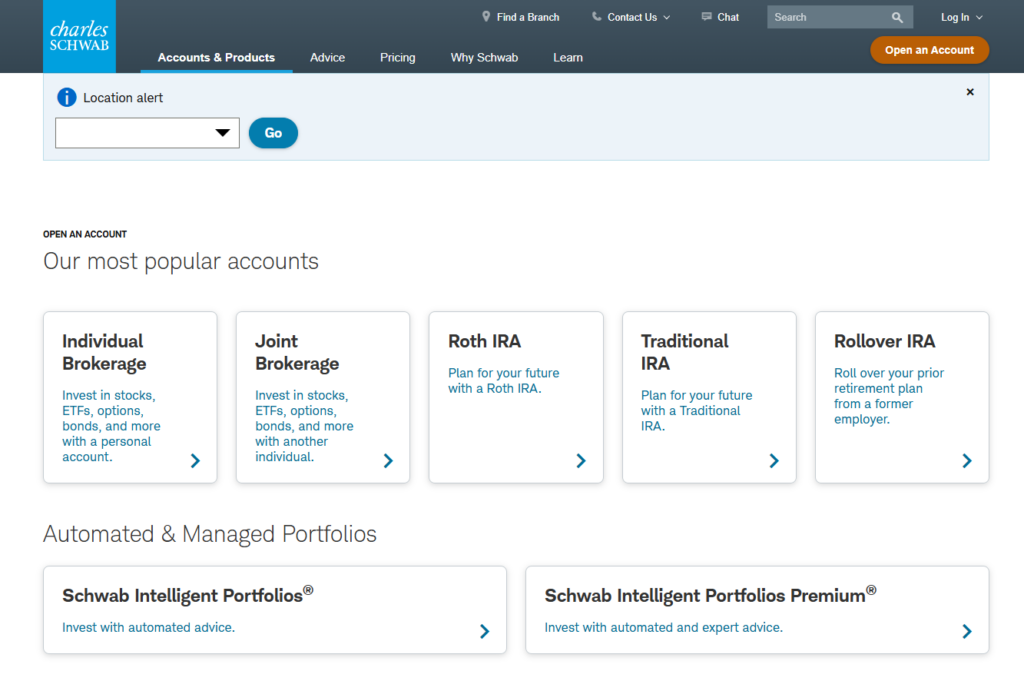

Wide Variety of Investment

Traders can trade practically everything they desire at TD Ameritrade, including equities, bonds, options, foreign exchange, futures, and of course, mutual funds. And if trading cryptocurrencies appeals, traders can do it through futures contracts rather than directly, as they do at several other brokerages.

Market Commentary

Through the Ticker Tape site, TD Ameritrade offers written commentary and analysis on the market every day. A wide range of topics is covered, including general finance, savings, retirement, and trading education, in addition to current markets. In addition to the Ticker Tape, TD Ameritrade also produces the quarterly print (and online) magazine thinkMoney, which is fully devoted to education. The simple line is that TD Ameritrade is exceptional for trading stocks and options.

Research and Account Features

All the research options and analytical tools you would anticipate from a significant online broker are available at TD Ameritrade. You can choose from a wide selection of screeners, calculators, charts, and analytic tools, to mention a few. Along with this already lengthy list, TD Ameritrade has included additional cutting-edge capabilities, such as the Social Sentiment tool, which analyzes social media trends.

TD Ameritrade Pricing

When a trade is made, trading fees are charged. Commissions, spreads, interest rates, and conversion costs are a few examples. Non-trading fees also include charges that are not directly tied to trading, such as withdrawal or inactivity fees. For each asset category, the TD Ameritrade fees that are the most pertinent are listed below:

- Transaction costs.

Many US brokers eliminated commissions for stocks and ETFs in 2019; TD Ameritrade was one of them. They provide commission-free trading in stocks and ETFs. For instance, the benchmark GBP/USD charge at TD is under $9 GBP/USD, compared to $10.7 at interactive brokers. Bond fees are $0, $50 for funds, and $6.5 for options. According to the quantity of traded options contracts. Last but not least, futures commissions cost $2.25 per contract and are calculated based on volume.

- Non-trading fees

Deposits are free, withdrawals are free if you utilize an ACH transfer, and the broker does not charge an inactivity fee. For non-US customers, there is only one withdrawal option, and it costs $25.

How to Open an Account?

The procedure for opening an account is simple and easy. However, you might need to provide additional information to verify your identification while completing the online account opening form, such as your Social Security number or Individual Taxpayer Identification Number (ITIN), as well as the name and address of your employment (if applicable). To register for a TD Ameritrade account, follow these simple steps:

- Start the application process.

- Fill in your details.

- Review and modify the data.

- Accept the terms.

- Set up your online account.

In Conclusion

Both new and seasoned investors will find TD Ameritrade to be a perfect fit for their needs, especially if they’re searching for a full-featured online broker with excellent instructional tools. It is ranked as one of the top online brokerages, bolstered by extensive educational resources and first-rate client support.

TD Ameritrade charges roughly average service costs. Like the majority of its top competitors, they don’t charge any trading commissions for online stock and exchange-traded fund (ETF) purchases. The brokerage charges commissions and fees at rates that are often equivalent to those of other services.

TD Ameritrade Review Overall

TD Ameritrade is an excellent choice for both new and experienced investors. It offers commission-free stock and ETF trading, low forex fees, and no inactivity fees. The platform includes mobile apps, a website, and the acclaimed thinkorswim desktop platform.

With 24/7 customer support and extensive educational resources, TD Ameritrade is user-friendly and supportive. However, it does not support direct cryptocurrency trading or fractional shares. Overall, TD Ameritrade is a reliable, feature-rich broker with strong educational tools and customer service.

Pros

- Commission-free stock and ETF trades

- Low forex fees and no inactivity fees

- High-quality trading platforms (mobile, web, thinkorswim)

Cons

- No direct cryptocurrency trading

- No fractional shares

-

Trading and Account Fees:

-

Supported Assets and Platform Features:

-

Customer Support and Educational Resources: