Pricing

Tiger Funded offers two main funding challenges:

- 1-Step Challenge:

- $10K account: $75

- $25K account: $150

- $50K account: $300

- $100K account: $500

- $200K account: $700

- $300K account: $849

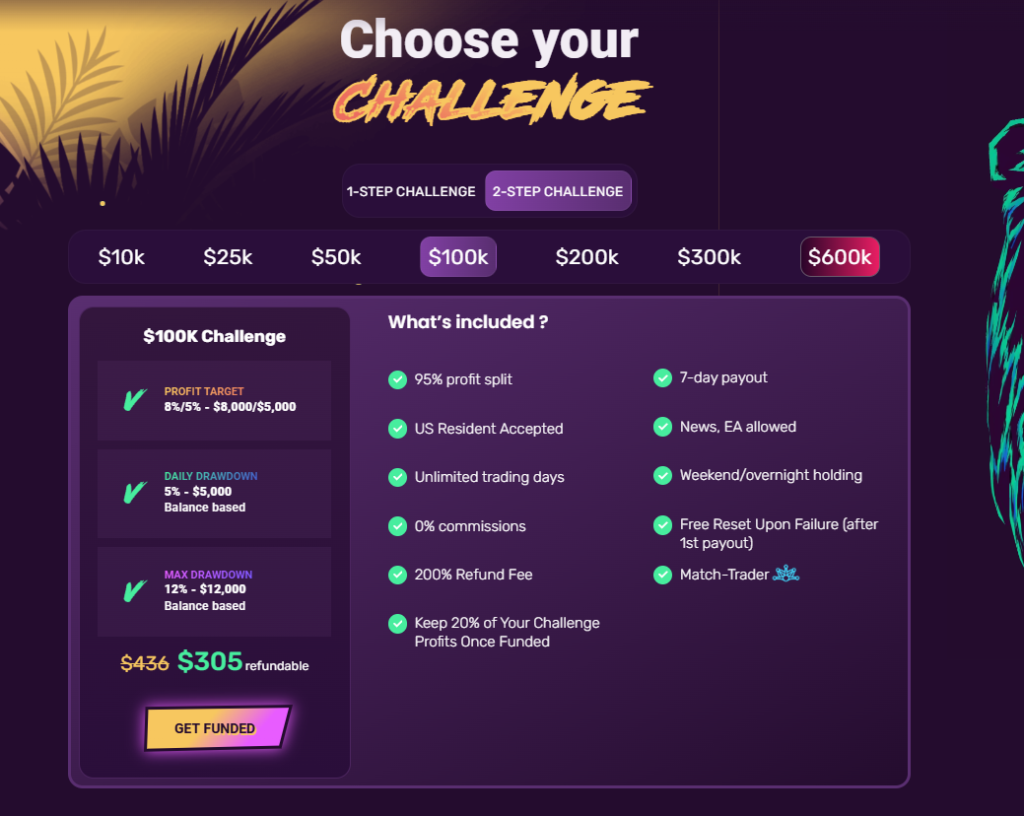

- 2-Step Challenge:

- $10K account: $67

- $25K account: $130

- $50K account: $250

- $100K account: $450

- $200K account: $650

- $300K account: $850

- $600K account: $999

These fees are refundable after your second payout, covering the evaluation process, and include unlimited trading days and no commissions.

Platform

They use Match Trader, a TradingView-based setup. It’s got solid tools like customizable charts, advanced indicators, and support for various strategies, including automated and news trading. No commissions, which is a plus for active traders.

Type

Tiger Funded provides two types of funding challenges:

- 1-Step Challenge: Hit a 10% profit target within certain drawdown limits to pass quickly.

- 2-Step Challenge: Requires an 8% target in Phase 1 and 5% in Phase 2 with flexible drawdown rules.

Customer Service

Customer support is available through live chat, phone, and email, ensuring that traders receive timely assistance. Additionally, Tiger Funded maintains a community-driven environment where traders can exchange ideas and support each other.

Pros

- 95% profit split.

- 1-Step and 2-Step challenges with no time limits.

- Supports various strategies (news trading, copy trading, EAs, overnight holds)

- Account scaling options up to $4 million.

Cons

- Newer prop firm, with less industry experience.

Tiger Funded Review

Tiger Funded stands out with flexible trading challenges and a strong 95% profit split for funded traders. With a choice between a 1-Step and 2-Step evaluation, traders can pick their preferred path to funding. They support U.S. residents and offer perks like keeping 20% of profits earned during the evaluation phase once funded. For flexibility, they allow unlimited trading days, news trading, Expert Advisors (EAs), and weekend and overnight holds, making it suitable for a wide range of strategies.

The firm’s commitment to guaranteed 7-day payouts, 0% commissions, and transparent policies creates an appealing environment for traders looking to advance their careers without hidden fees. Tiger Funded’s platform, Match Trader (built on TradingView), offers advanced tools like customizable charts, technical indicators, and automated trading options. The combination of flexibility, high earnings potential, and straightforward rules makes it attractive to both new and experienced traders.

About Tiger Funded

https://mytradingreviews.com/Founded in Dubai by professional traders, Tiger Funded focuses on helping traders grow by providing supportive tools, flexible rules, and the chance to scale up accounts up to $4 million. Their programs reflect the team’s deep expertise in trading, asset management, and risk management. With both a single-step and two-step evaluation process and free account reset after the first payout if you fail, Tiger Funded aims to offer a fair, growth-oriented path for traders while creating a transparent environment.

Who Should Use Tiger Funded?

Tiger Funded is ideal for traders at various experience levels, from new traders honing their skills to experienced pros looking for a solid profit split and funding growth. The platform’s flexible evaluation paths (1-Step and 2-Step) make it suitable for different risk tolerances and trading styles, whether you’re a day trader, swing trader, or someone who uses news events or automated strategies.

Tiger Funded’s unlimited trading days, 0% commissions, and scaling options up to $4 million provide room to build a career without unnecessary restrictions. With features like free resets after the first payout, 20% profit retention from challenges, and 95% profit split once funded, it’s designed to appeal to traders looking for flexibility, growth, and fair terms. The platform adapts well to different styles and goals, making it worth considering if you’re aiming to build serious capital over time.

Tiger Funded Platform & Features

Tiger Funded uses Match Trader, a TradingView-based platform with advanced charting, technical indicators, and automated trading options. It’s built for flexibility, allowing news trading, overnight holds, and no commission fees—ideal for a variety of trading styles.

Tradable Assets

Tiger Funded offers a broad range of assets:

- Forex: Major, minor, and exotic currency pairs.

- Indices: Popular global indices with low spreads.

- Commodities: Gold, silver, oil, and more.

- Cryptocurrencies: Bitcoin, Ethereum, and other major cryptos.

Scaling Plan

Tiger Funded offers a structured scaling plan, allowing traders who consistently hit a 10% profit every 30 days to grow their account size. Successful traders can expand their capital base up to $4 million, with account increases based on steady performance. This feature lets high-performing traders manage progressively larger funds.

Payment Methods & Withdrawals

Tiger Funded provides flexible payment options, including credit/debit cards, bank transfers, and cryptocurrencies. Withdrawals are processed weekly, with 7-day payouts available. Traders can withdraw up to 95% of their profits without additional fees, making it a hassle-free experience. Payout options also support multiple currencies for added convenience.

Trading Rules

Tiger Funded allows traders broad flexibility in strategy. They support hedging, martingale, and EAs (Expert Advisors), and traders are allowed to hold positions overnight or through weekends. News trading is also permitted, with no mandatory stop loss requirement, providing freedom for various trading styles and strategies.

Evaluation Process

- 1-Step Challenge: Traders need to reach a 10% profit target with a 3% daily drawdown limit and a 6% maximum drawdown.

- 2-Step Challenge:

- Phase 1: 8% profit target with a 5% daily drawdown and 12% maximum drawdown.

- Phase 2: 5% profit target, maintaining the same drawdown limits as in Phase 1.

Once traders pass either evaluation, they’re funded with access to a 95% profit split. Combined with Tiger Funded’s flexible rules and scaling options, this structure is geared toward traders aiming to maximize profits and scale up without unnecessary restrictions.

Tiger Funded Pricing

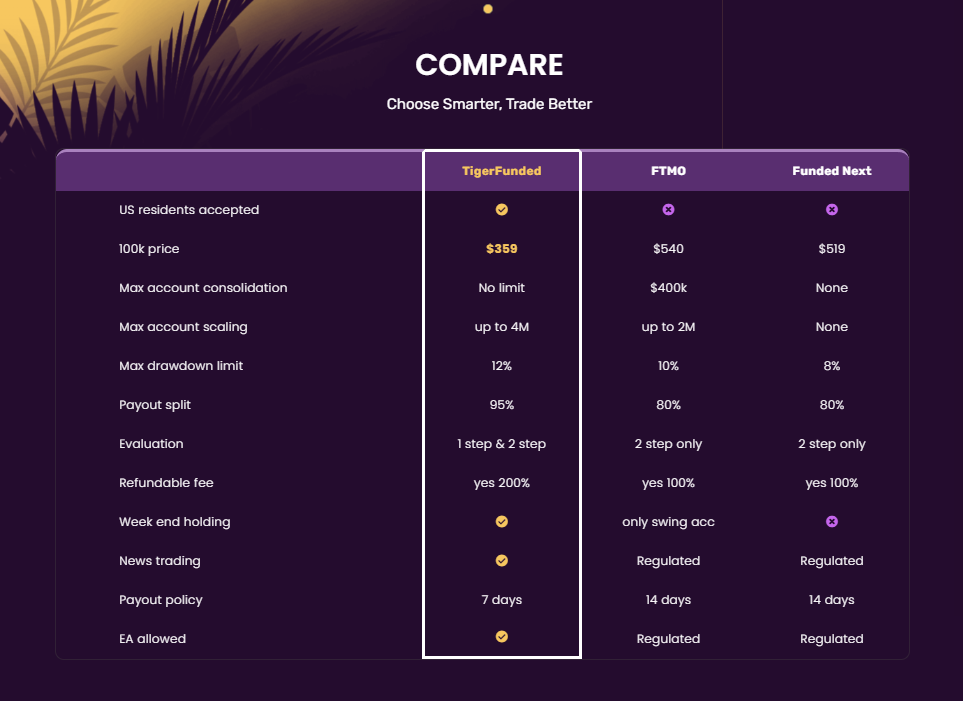

Tiger Funded offers competitive pricing, with the 1-Step Challenge starting around $75 and the 2-Step Challenge starting at about $67 for smaller accounts, scaling up for accounts as large as $600K. This flexible pricing structure makes it accessible for traders with different capital goals and risk preferences, and all fees cover the full evaluation process. Compared to other major prop firms like FTMO and FundedNext, Tiger Funded’s pricing is often more budget-friendly, especially for entry-level accounts.

FTMO only offers a 2-Step Challenge with a profit split up to 90%, and they provide a refund on challenge fees once the evaluation is passed. They also offer a 25% account scaling increase every four months for traders who meet consistent profitability targets. FundedNext, also a 2-Step Challenge provider, starts traders at an 80% profit split, which can rise to 90% for top performers. They support bi-weekly payouts, weekend holding, and have a structured account scaling plan.

Tiger Funded stands out with its 95% profit split, the flexibility of unlimited trading days, a free reset after the first payout, and a 7-day payout cycle. These features make it attractive to traders aiming to maximize both earnings and flexibility, without high entry costs.

In Conclusion

Tiger Funded presents a viable option for traders interested in funded accounts, offering flexible pricing and a choice between 1-Step and 2-Step challenges. With a high profit split of 95%, unlimited trading days, and regular 7-day payouts, Tiger Funded caters to a range of trading styles. Compared to other firms like FTMO and FundedNext, its entry costs are often lower, making it accessible for traders at different levels. The combination of account scaling, free reset after the first payout, and strategy flexibility—like allowing news trading and EAs—positions it as a reasonable choice for traders seeking growth potential in a funded trading environment.

Tiger Funded Review Overall

Tiger Funded offers flexible funding options, a 95% profit split, and excellent trading conditions on MatchTrader platform. While relatively new, it provides solid customer service and transparent rules with no hidden fees. Ideal for traders seeking a competitive and scalable prop firm, though it’s still building industry trust.

Pros

- Generous 95% profit split

- Flexible evaluation challenges (1-Step and 2-Step)

- No time limits, allowing traders to proceed at their own pace

Cons

- Still a newer firm, requiring time to build industry reputation

-

Funding Options and Pricing:

-

Trading Conditions and Platform:

-

Customer Service and Trust: